Carbon accounting: learnings from the governance journey

How companies understand their sustainability-related governance may hold the key to meeting climate goals and thriving in a net-zero economy ...

by Ralf W. Seifert, Yara Kayyali Elalem, Laurence Bongrain Published 10 March 2023 in Strategy • 7 min read

The voluntary carbon market provides alternative methods for offsetting emissions towards net-zero goals set by firms. However, scandals – including a recent investigation by The Guardian, Die Zeit, and SourceMaterial questioning carbon credits generated from REDD+ (Reducing Emissions from Deforestation and forest Degradation) projects issued by Verra, the world’s leading carbon standard – means their use remains controversial. A lack of transparency, oversight, and traceability has further undermined trust in the market and raised several questions. Are companies purchasing carbon credits only when they have exhausted all other possibilities to decrease their emissions? Or are carbon credits merely a financial product for corporate greenwashing?

Studies have shown that only a fraction of the 100 million carbon credits issued so far have resulted in actual emission reductions. To strengthen the carbon market and make it a viable solution to tackle climate change, McKinsey has stated the need for a large, transparent, verifiable, and environmentally robust voluntary carbon market.

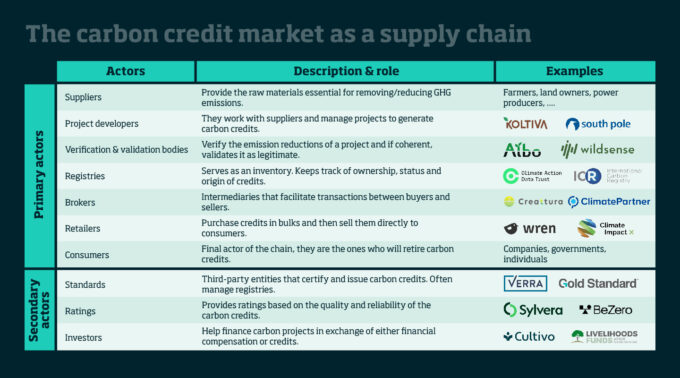

To understand how to improve the carbon credit market, it can help to think of it as a supply chain in need of a significant performance improvement. Considerations of the various stakeholders, sources and availability of supply, rising demand, and quality assurance of the credits granted need to be addressed. Mapping this supply chain of carbon credits is challenging, as carbon credits are intangible assets that are traded in different markets, supplied and demanded by various stakeholders (see Table 1).

On the supply side, the stakeholders involved in the carbon market are the project developers and landowners, for example, for reforestation projects. On the demand side, the stakeholders include governments, firms, and even individuals. Brokers and traders serve as a link between supply and demand. Standards, or carbon crediting organizations, support the existence of the credits by providing verification, validation, monitoring, and auditing of the carbon credits (examples include Verra and Gold Standard). Registries serve as inventory, keeping track of ownership, status, and use of credits.

Buying carbon credits can be compared to buying wine; you can choose between different vintage, origin, quality, and so on. The variation in quality and prices of carbon credits are reflected in the variety of existing standards. One of the roles of carbon standards is to increase the complexity of carbon credit generation to ensure the veracity of the credit. What standards are to carbon credits can be thought of as what ecolabels are to products. Current fragmentation of ecolabels and the lack of consensus on criteria are perceived as ecolabels’ most difficult challenges. These challenges are equally important to carbon credit standards. The voluntary carbon market is far from being regulated and has not reached maturity, leading to a lack of regulation and standardization of carbon credit generation. Rules, rather than being set by national or international public authorities, are set by standards which are private entities. The lack of governance and unified standards make the voluntary carbon market in need of more transparency to verify the true value behind the credit.

The current market value for carbon credits exceeds $2 billion. McKinsey predicts that the market value could exceed $50 billion in 2030 as carbon credits gain importance closer to 2030 and 2050. After the scandal of the forestry-related carbon credits, their demand experienced a drop from 380 million in 2021 to 359 million in 2022. However, interest in other forms of carbon credits continues to increase. The interest in carbon credits is also reflected in research, which grew more than 30-fold from 2000 to 2022. With rising demand for carbon credits, improvements to their viability need to be implemented. Like any supply chain, transparency, traceability, and monitoring of the carbon market are key to its success. Advancements such as using blockchain technology to help improve transparency in the carbon market have not yet materialized. Meanwhile, satellite imaging is already being used to monitor carbon credits generated from forests and rice paddies to ensure the fields and agricultural practices which correspond to those credits are maintained in the future. Moreover, groups such as the Integrity Council for the Voluntary Carbon Market have already started working on publishing a set of Core Carbon Principles to test the verification process used by carbon credit standards such as Verra. The principles will act as a reassurance to the validity of the carbon credits bought.

Against this backdrop, several companies are starting to change their minds on how to use carbon credits in their sustainability strategies. According to a sustainability manager in one multinational company: “The big change in mentality is going from offsets to insets.” The fight against climate change will not be won if organizations offset their emissions instead of decarbonizing their own value chains. The rising trends and high records of global carbon dioxide from energy combustion pose a question on whether firms are truly reducing their emissions or will eventually rely on the carbon market to achieve their net zero targets. It is therefore important to have independent sustainability-auditing organizations that analyze the use case of carbon credits in a firm’s emission reduction journey.

On one hand, if the firm’s use of carbon credits is to offset emissions that are unavoidable and cannot be reduced by other means, then the carbon credits can be counted towards the firm’s net zero target. On the other hand, if carbon credits are merely used as a tool for a firm to buy itself out of its carbon impact and continue business as usual, audits should ensure that these credits are not counted towards the firm’s net zero target.

With an increasing interest in carbon credits and their trade, the reason behind the increasing number of firms investing in more agricultural and forestry practices seems somewhat questionable. Are these firms investing in such practices for the greater good, or is it an investment to generate carbon credits that will eventually be traded with high profit returns in the future? With a projected increase in carbon credit prices, the latter seems to be a very attractive investment opportunity. Therefore, comprehensive governance and regulations must be imposed on the carbon market to avoid it turning into another commodity traded more or less exclusively for profit.

It is crucial for firms to start analyzing trajectories of their emission reductions. Based on their trajectories, they can decide on whether they can truly achieve net-zero operations given their respective timelines by using the available levers, or whether they need to invest in other alternatives such as carbon credits. Due to economic, operational, or procedural constraints, companies may still have residual emissions after aggressive internal decarbonization. If purchasing carbon credits is the only way forward after exhausting all other emission reduction strategies, firms must ensure that the credits they are investing in truly reflect the amount of reduced emissions.

By being transparent in their reporting and claims, and prioritizing internal emission reductions, firms can achieve credibility for using carbon credits. A recent report by Carbon Market Watch shows the transparency and integrity of several companies by assessing both their emissions reduction and offsetting claims. While Maersk ranks the highest in overall transparency and integrity compared to the other companies listed, they show only moderate transparency for their future offsetting plans, meaning they were only ranked reasonable in overall transparency and integrity in the Corporate Climate Responsibility Monitor 2023 assessment.

Naturally, profitability is important to firms and they can purchase the credits that are deemed necessary before prices are expected to increase. Firms that see investment in credits purely as a mere trading opportunity, however, will need to reflect on how this might negatively affect their image even if they manage to reach their emissions targets.

Professor of Operations Management at IMD

Ralf W Seifert is Professor of Operations Management at IMD and co-author of The Digital Supply Chain Challenge: Breaking Through. He directs IMD’s Leading the Future Supply Chain (LFSC) program, which addresses both traditional supply chain strategy and implementation issues as well as digitalization trends and the impact of new technologies.

Yara Kayyali Elalem holds a bachelor’s degree in Civil and Environmental Engineering and a master’s degree in Management, Technology, and Entrepreneurship. Currently, she is pursuing her PhD in the Technology and Operations Chair at EPFL. Her PhD research focuses on demand forecasting for new products and operational flexibility strategies for sustainable sourcing.

Master student at EPFL, Intern at Creattura,

Laurence Bongrain is a 2nd year master student in the Management, Technology, and Entrepreneurship program at EPFL. Her master thesis maps the supply chain of carbon credits and discusses implementation challenges. Her internship is hosted by Creattura, a Japanese sustainability consulting company.

16 November 2023 • by Ralf W. Seifert, Richard Markoff, Alexander Schmidt in Supply chain

How companies understand their sustainability-related governance may hold the key to meeting climate goals and thriving in a net-zero economy ...

14 November 2023 in Supply chain

Henrik Andersen discusses with IMD President Jean-François Manzoni the challenges of navigating supply chain disruptions and soaring raw material costs over the past three years, and why he changed the wind farm...

7 November 2023 • by Mark J. Greeven, Patrick Reinmoeller in Supply chain

Li Shufu, CEO and founder of Chinese carmaker Geely, overcame a host of setbacks to become the billionaire owner of a multi-faceted business ...

4 October 2023 • by Carlos Cordon in Supply chain

De-risking strategies, sustainability considerations, and geopolitical awareness will play pivotal roles in reshaping how businesses operate in the years to come....

Explore first person business intelligence from top minds curated for a global executive audience