Reimagining the workplace

Intriguing innovation has opened up a “third space” to combine the advantages of the office and homeworking environments, suggest Johan Bjuregård and Peter Ingman, Co-Founders of Flowpass. ...

by Ralf W. Seifert, Olov H. D. Isaksson Published 16 February 2022 in CEO Circle • 5 min read

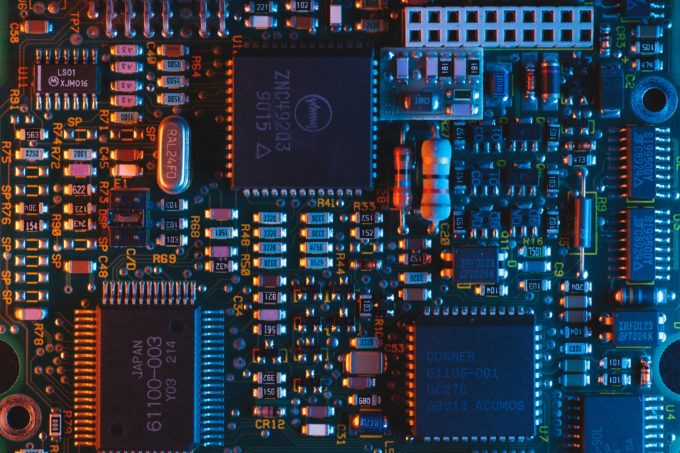

Executives in our training programs have become accustomed to the dreaded “bullwhip effect” over the past year, a phenomenon when sudden spikes in demand are amplified upstream in the supply chain, from the consumer to the retailer to the distributor to the producer, which races to increase production for demand that turns out to be phantom.

Supply chain managers have responded to the dramatic rebound in global demand after the COVID-19 shutdowns by double-ordering and overstocking supplies. Economists have blamed product shortages such as semiconductors and the present spike of inflation, to an extent, on the bullwhip effect.

The bullwhip is known to cause great inefficiencies and cost increases through excess inventory, lost revenues, superfluous capacity and poor customer service. So why does a known phenomenon continue to wreak havoc on global supply chains? The bullwhip effect has not, in the main, been suppressed by the various entities along the supply chain. So what can be done to improve the situation?

Bullwhip is not a new phenomenon: it has received strong attention from both researchers and practitioners since the 1960s. Our own research in 2016 provided new evidence regarding the effect’s prevalence and magnitude. We found some firms experienced strong bullwhips while others did not. On average, demand variability is 90% higher for the supplier than for the buyer. The magnitude is stronger the further upstream in the supply chain you go: the retail sector experienced less of a bullwhip than manufacturing did.

Hence, we now know a great deal of the factors that cause the bullwhip effect, and what companies can do to reduce it. Decades of globalization, outsourcing and just-in-time production have led to more cost-effective supply chains, but these trends have increased their vulnerability to increasingly costly disruptions.

As supply chains have become longer and leaner, the lack of coordination, information-sharing and transparency have caused the bullwhip. The pandemic amplified those pressures and created new ones, such as a suddenly changing product and channel mix, as well as labor shortages. This caused a “perfect storm” for supply chains.

At the same time, many traditional bullwhip mitigation strategies were rendered ineffective due to changes in the global workforce, shortages in transportation capacity and modified customer behavior.

In recent decades firms have made significant investments in technology to counter the bullwhip, mostly to improve information sharing and transparency with software, cloud services and other collaborative efforts. Other measures include keeping prices stable and rationing orders.

Various case studies have illustrated their success in increasing operational efficiency. However, even before the pandemic it was clear that these measures were only partly, if at all, successful in suppressing the bullwhip effect. We studied 15,000 firms between 1976-2009 and observed no significant decrease in the bullwhip over time.

Anecdotally, one common denominator of the firms that handled the bullwhip well was that they already had supply chain management at the top of their corporate agenda. In many cases, the most successful firms had given this issue attention at the board-level.

One strong contributor to the bullwhip effect is long lead times. Zara, owned by Spanish fashion group Inditex, has reinvented its supply chain so as to become more agile. This strategy depends on quick-response manufacturing: Zara uses contract manufacturers in the La Coruña region in north-west Spain, close to its headquarters. The proximity to design centers and the European market dramatically shortens distribution times. This has helped the company to handle the supply chain crisis well compared to competitors with longer lead times.

Another success factor that we have identified in firms that have suppressed the bullwhip is the ability to reduce product complexity and product variety during the pandemic disruption. A large consumer goods manufacturer, for instance, reduced their product portfolio and concentrated on strong sellers, which made it easier to plan and predict demand. So there was less of the panic ordering for phantom demand that has overwhelmed suppliers across the globe.

Similarly, numerous car manufacturers, such as BMW, General Motors and Mercedes-Benz, cut-down on high-end features when the supply of computer chips became constrained last year. This not only helped to avoid supply chain inefficiencies upstream, it made it possible for these companies to maintain production and delivery schedules, to an extent, despite the turmoil in supply chains.

During the pandemic it has also become clear that behavioral factors are strong drivers of the bullwhip. One example is “shortage gaming”, when customers place multiple orders for a product with numerous suppliers if they expect inventory to be in short supply. It is thus important to make sure that incentives are aligned across the supply chain.

For example, a manufacturing company that we talked to for our research managed to cope with inflated orders by analyzing if they deviated too much from historic sales or actual consumption downstream in the supply chain. By refusing excessive orders from some clients, the company did a much better job of giving all clients what they really needed and captured more market share overall.

But some firms are unable to do this because they have become too automated and procedural in their ordering process. While automation can improve efficiency, over-automation makes it hard to quickly react. The firms had to enact manual overrides in their software systems to reroute orders as needed — for example, to leverage spare capacity in factories that would not serve certain markets during normal times.

Lastly, it has become increasingly evident that government policy will play an important role in countering the bullwhip. In the US, President Joe Biden has convened a supply chain disruption taskforce to help strengthen the resilience of critical supply chains. The idea is to “act as an honest broker to encourage companies, workers and others to stop finger-pointing and start collaborating”.

Other countries, such as Sweden, have placed limits on the number of certain items, such as prescription drugs, that can be purchased in a certain time period, to stop consumers hoarding goods. Such measures, whether they stem from policy or practice, will be needed to fix incentives, improve transparency and communications across the supply chain. The bullwhip has been in the headlines during the pandemic, but it has been prevalent before COVID-19, and will still need to be carefully managed thereafter.

Professor of Operations Management at IMD

Ralf W Seifert is Professor of Operations Management at IMD and co-author of The Digital Supply Chain Challenge: Breaking Through. He directs IMD’s Leading the Future Supply Chain (LFSC) program, which addresses both traditional supply chain strategy and implementation issues as well as digitalization trends and the impact of new technologies.

Olov Isaksson is Associate Professor of Operations Management at Stockholm Business School, Stockholm University. His primary research topics relate to operations management and its intersection with retail, healthcare, and innovation management. With a special interest in data analytics, Olov uses data and empirical approaches to investigate how firms can make better operational decisions.

11 September 2023 • by Johan Bjuregård, Peter Ingman in CEO Circle

Intriguing innovation has opened up a “third space” to combine the advantages of the office and homeworking environments, suggest Johan Bjuregård and Peter Ingman, Co-Founders of Flowpass. ...

17 February 2023 • by Susan Goldsworthy in CEO Circle

When senior employees at Dutch firm IG&H walked away in frustration with the company’s leadership, founder and CEO Jan van Hasenbroek realized that things had to change. Susan Goldsworthy, Affiliate Professor of Leadership,...

9 December 2022 • by Shlomo Ben-Hur, Steven Smith in CEO Circle

To retain the best and grow talent, organizations must recognize that learning and development is no longer a “nice to have”. ...

8 December 2022 • by Lars Häggström in CEO Circle

Much of the concern about workers disengaging from their jobs focuses on the younger generations. This misses an opportunity to consider how leaders can raise engagement across the workforce....

Explore first person business intelligence from top minds curated for a global executive audience