How to teach an entrepreneur to let go

Biotech entrepreneur Juana Lucia Flores-Candia explains that technology has changed the way to mentor chief executives. Here are her three ways to get entrepreneurs to focus....

by Jerry Davis Published 18 March 2021 in Magazine • 5 min read

Tiny Denmark’s largest company is as big as any non-state enterprise in China, while global “giant” Netflix has fewer than 10,000 employees worldwide. The old corporate giants are like dinosaurs waiting to be wiped out by the nimble new beasts in the jungle, argues Jerry Davis.

Populist movements around the world are challenging the power of Big Business. The left sees monopolists overtaking industry after industry and crushing competition, while the right is incensed by tech giants exercising arbitrary control over political speech ‒ for instance, by de-platforming disfavored political leaders and their followers. Either way, the diagnosis is clear: when it comes to business, big is bad.

But what exactly is big about big business? Is Zoom a big business? Since the start of the pandemic, Zoom has been inescapable in the daily life of business and education, far outstripping competitors like Microsoft Teams, Google Meet, Facebook Messenger or Skype. Yet according to Zoom’s 2020 annual report, it had only 2,532 employees globally. How about Netflix? Also pervasive and even more global, with offices in 59 countries; yet Netflix has just 9,400 full-time employees.

Perhaps “big” has outlived its usefulness as a metaphor for business. In the 21st century, size per se may be a less important source of power than the ability to project. Let’s call it loud business.

When it comes to the corporation, there are many ways to be big: revenues, assets, profits, employees, market capitalization. Although these were highly correlated during the industrial era, they are increasingly divergent today.

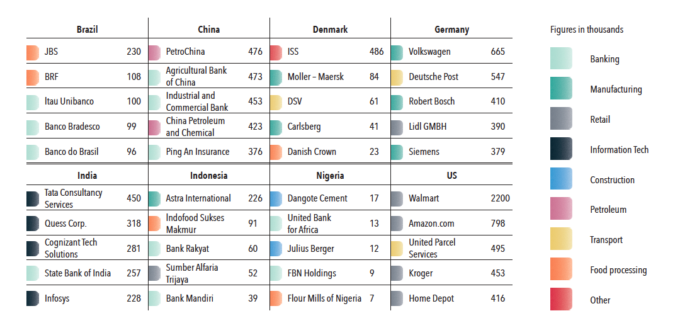

The table shows the five biggest employers in each of eight countries according to a 2020 study by Aseem Sinha and myself. Several things jump out immediately. We might have expected that the size of the biggest private companies would be proportional to the size of the country: giant countries such as China and India and Brazil would host giant domestic companies, whereas tiny countries, Denmark for example, would have tiny local companies. But that’s not the case. In fact, the biggest company based in Denmark is slightly bigger than those in China and India. (To be clear, the employment figures are global; ISS does not employ 10% of Denmark’s population. And the organizational boundaries of state-owned enterprises in China are complicated.) Countries differ dramatically in their ability to grow giant companies.

We might also expect that the biggest local companies would be in the same industries

around the world, but that is also not the case. India’s biggest businesses are in IT services. Germany’s are manufacturers. America’s are in retail. In lower income countries, banks are often among the biggest domestic employers, but there are also big local companies in meat (Brazil), cement (Nigeria), and instant noodles (Indonesia).

Why is “big business” so different around the world? Consider an analogy: suppose we had asked what were the five biggest native mammal species in each country or the five tallest tree species. To understand them, we would turn to the features of soil and climate and geology and the other species in the ecosystem that enable large animal and plant species to thrive.

Business also requires an ecosystem to support it. Creating an organization requires capital, labor, supplies, distribution, and methods of management within the enterprise. Crucially, the markets for each of these factors inherently depend on a country’s domestic institutions.

Most countries in the world did not have a functioning domestic stock exchange before 2000, so if your business required a lot of capital to grow, you either needed rich friends or amiable bankers. If your business model relies on skilled coders, it helps to have a strong university system to prepare the labor force. A country’s product market regulation will grow different kinds of businesses depending on whether its priority is encouraging competition at home or breeding national champions for export markets. In combination, these factors will shape what kinds of business grow big and how big they grow. In short, the national ecosystem shapes the kinds of big firms we see.

But there is more: over the past three decades, each of the core factor markets in the business ecosystem have been transformed by information and communication technologies (ICTs). In the US, this has taken the form of financialization (a shift to market-based financing over bank-based lending across the value chain), Nikefication (outsourcing non-core aspects of business), Uberization (the use of non-employee contractors), and the advent of Amazon and others for distribution. If you want to start a business in the US today, all the components are available online, at least in principle, and it is possible to recruit capital, labor and supplies from around the globe. Consider this as the corporate equivalent of the meteor that changed the climate and killed off the dinosaurs: when core elements of the ecosystem change, then old species are wiped out and new ones arise.

This also means that the sources of corporate power are different. In the last century power came from being big. Today being big is not necessarily an advantage and may be a disadvantage.

Instead, the new source of power is being a gatekeeper, a term of art that figures centrally in the EC’s proposed Digital Markets Act. Cristina Caffara and Fiona Scott Morton define a gatekeeper as “an intermediary who essentially controls access to critical constituencies on either side of a platform that cannot be reached otherwise, and as a result can engage in conduct and impose rules that counterparties cannot avoid”. That is, the source of a gatekeeper’s power is not being big but being central in networks terms; standing between. And as Caffara and Scott Morton point out, being a “gatekeeper” depends crucially on a company’s business model. Broadly, there are ad-funded digital platforms (Facebook, Twitter); matchmaking or marketplace platforms (Amazon, Uber, Airbnb); and operating system ecosystems (Apple’s Appstore; Android; Amazon Web Services). These provide different potential sources of power.

Combined with our prior discussion of corporate ecosystems, this suggests that the biggest source of corporate power today is being a gatekeeper for one of the core business factor markets: capital, labor, supplies or distribution.

Consider the reliance of Netflix on Amazon Web Services. According to the latest Netflix annual report: “Currently, we run the vast majority of our computing on AWS.” And the IPO prospectus for Doordash states: “We primarily rely on Amazon Web Services to deliver our services to users on our platform, and any disruption of or interference with our use of Amazon Web Services could adversely affect our business, financial condition, and results of operations.” Similarly, right wing social media platform Parler disappeared for more than a month when AWS cut off its contract.

This gives us a new perspective on corporate power. While Walmart might be big, Amazon is loud.

Professor of Business Administration and Professor of Sociology, University of Michigan’s Ross School of Business

Jerry Davis is the Gilbert and Ruth Whitaker Professor of Business Administration and Professor of Sociology at the University of Michigan’s Ross School of Business. He has published widely in management, sociology, and finance. His latest book is Taming Corporate Power in the 21st Century (Cambridge University Press, 2022), part of Cambridge Elements Series on Reinventing Capitalism.

20 November 2023 • by Juana Lucia Flores-Candia in Leadership

Biotech entrepreneur Juana Lucia Flores-Candia explains that technology has changed the way to mentor chief executives. Here are her three ways to get entrepreneurs to focus....

17 November 2023 • by Michael D. Watkins in Leadership

Executives winning promotion must navigate their transition with a balance of humility, respect for legacy, and a vision for the future....

14 November 2023 in Leadership

Henrik Andersen discusses with IMD President Jean-François Manzoni the challenges of navigating supply chain disruptions and soaring raw material costs over the past three years, and why he changed the wind farm...

6 November 2023 • by Brenda Steinberg, Michael D. Watkins in Leadership

Strategic thinking is key to career advancement – but communicating it to others is just as important. Ask yourself these 10 questions to find more ways to demonstrate your strategic abilities to...

Explore first person business intelligence from top minds curated for a global executive audience