Make sure the unit economics work before going big

If top-line growth is no longer sufficient, earning quality is what the financial market is paying attention to. Of course, the financial market has a long list of measurements to gauge earning quality and cash flow consistency. The key is consistency. Erratic behavior is a sign of cutting corners or losing control.

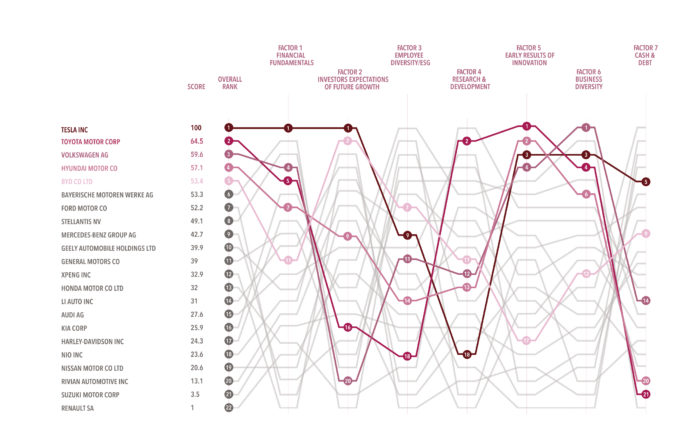

That’s why Tesla is interesting. The Tesla of 2022 is very different from the one of 2018. Back then it was still figuring out how to ramp up production of Model 3. These days, Tesla is pulling ahead further, from revenue growth to free cash flow. Other top-ranking companies like Toyota and VW are doing well too. Their financial performance is solid. The difference is that these traditional carmakers are being hurt by the semiconductor shortage, and there is no way out. They have been shutting down their production lines because of the lack of chipsets. The better ones, like Toyota, have been stockpiling.

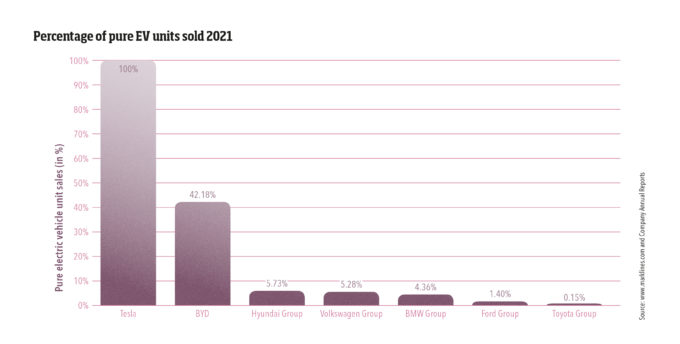

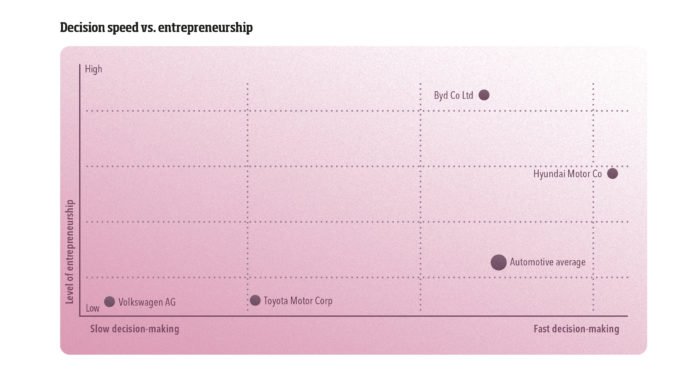

Then you have Tesla, which is so flexible in sourcing the component parts. Anything that is still available in the marketplace, Tesla uses it. Tesla is nimbler but not because of its culture. The soft side of things might help but they won’t save the company. It’s the hard skills and deep capabilities that make a difference. “We design circuit boards by ourselves, which allow us to modify their design quickly to accommodate alternative chips like power chips,” explains one Tesla employee. In other words, Tesla’s pursuit of vertical integration has moved the company into areas that traditional carmakers had shunned. And now it’s paying off.

And when there are no more chipsets anywhere, Tesla selectively downgrades features to reduce chipset requirements.

Elon Musk, as gruff as he has always been, said that other carmakers “will largely go to the traditional supply base and, like I call it, catalog engineering.” Meanwhile, he got work done directly with semiconductor manufacturers like Qualcomm. He didn’t let parts suppliers handle sourcing. He said carmakers aren’t “very adventurous”. And it’s Tesla’s early adventure that has resulted in today’s envy-worthy topline growth and production resilience.

Audio available

Audio available