Sustainable product portfolio management (SPM) at Solvay

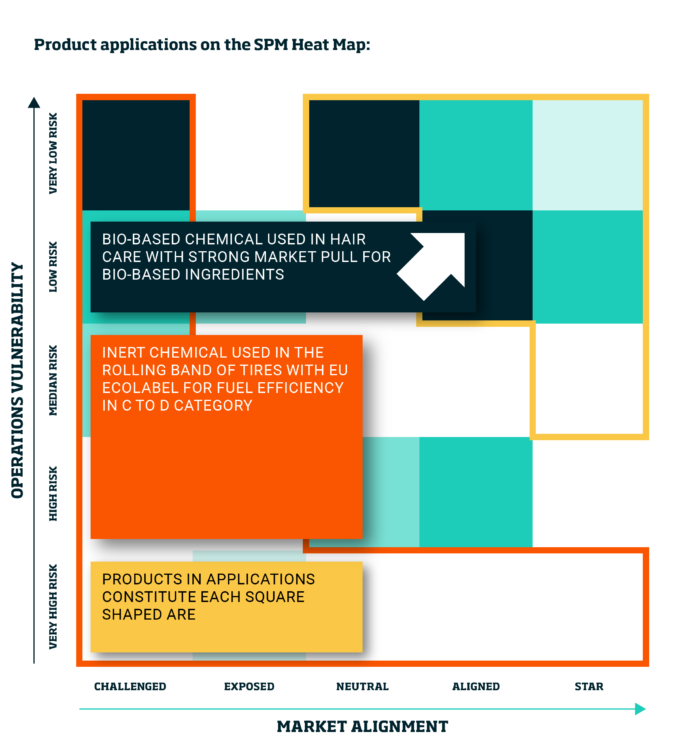

Solvay, a Belgium-based international chemicals and advanced materials company, uses an SPM heatmap (see illustration above) to steer its environmental footprint and identify its related risks and opportunities (vertical axis) and how these applications bring customer benefits (horizontal axis).

The heatmap categorizes products into three categories:

1. Solutions: products with a better sustainability contribution to Solvay’s customers and value chain, combined with a favorable balance between value and environmental impact.

2. Neutral: products without outstanding sustainability performance, if any, and low operations vulnerability which is not combined with favorable sustainability drivers in the marketplace. These are products that consumers need, but which do not contribute to environmental footprint reductions.

3. Challengers: products for which there are either strong negative signals resulting from sustainability drivers in the marketplace, or serious operations vulnerability challenges. These are products that may contribute to declining revenues over time and are likely to eventually disappear from the product portfolio (see Figure 1).

Keeping this product portfolio map on the radar of any management team can lead to non-sustainable products being discontinued and replaced with more sustainable solutions, as well as increasing marketing on solutions that are more sustainable.

Sustainable hurdles for product innovations at Evonik

Evonik, a German speciality chemical company uses a framework called PARC (Product, Application, Region, Combination) to provide guidance on product innovation decisions that enhance sustainability performance.

The underlying framework, developed by the chemical industry together with the World Business Council for Sustainable Development (WBCSD), helps companies to identify material, environmental and social challenges and opportunities related to any product and its application in a specific region.

Assessing sustainability using criteria defined by relevant stakeholder groups allows the company to test its own sustainability performance using a fact-based outside-in view. It highlights areas where changes in decision-making are likely to occur because of sustainability-related reasons. For instance, Evonik might ask a supplier to change the use of a material as it wants to ensure all products are traceable.

For each of the identified signals, which could imply either perceived sustainability benefits or concerns, the company shall decide on the materiality of the signal for the PARC categories. For product innovations, the criteria to be a leader can be outlined explicitly and thereby provide guidance into the product innovation process.

As a consequence, innovation teams will have more ambitious, sustainability compatible criteria to fulfil in a stage-gate process before they receive funding to proceed. This will ensure that the product portfolio roadmap continuously has more sustainable solutions.

Audio available

Audio available

Audio available