Navigating the data-driven landscape: the role of ambidextrous leadership

Leveraging real-world data can be transformative, and leaders need to both transform their core activities and pursue new opportunities....

by Patrick Reinmoeller Published 23 August 2021 in Asian hub • 5 min read

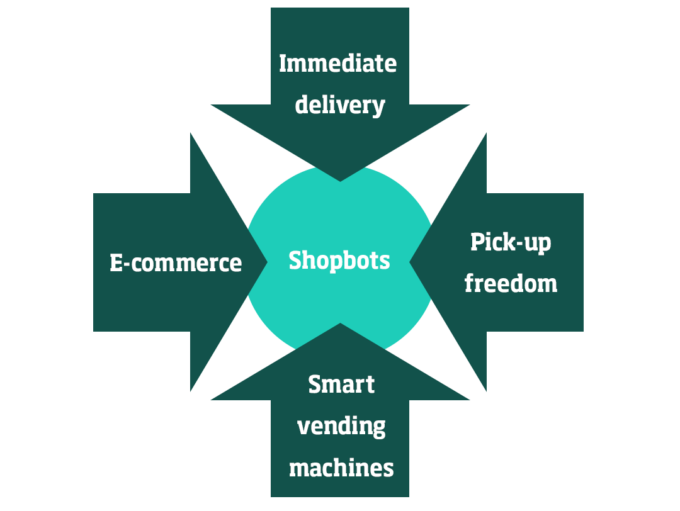

E-commerce’s recent COVID-19-fuelled boom has accelerated the arrival of new forms of delivery and delivery-related services. “As-fast-as-you-want” companies allow goods to be delivered when a buyer needs them – especially useful for perishable merchandise. Pick-up lockers are rapidly growing in popularity. Drones are another approach that many businesses are considering.

For those looking further into the future, even more exciting are the totally automated stores piloted by companies such as Amazon Go and Hema Fresh, where shoppers put purchases straight into their bags and have the bill settled by their mobile phone as they walk out.

Yet there’s also one other channel that shouldn’t be overlooked – the one found on streets, in malls and in office and school lobbies across Asia – the vending machine.

Japan has long been the world’s vending machine heartland, with its more than 4 million machines offering everything from soft and alcoholic drinks to food, cigarettes and even toys. At one for just over every 30 people, its penetration rate is nearly double that of the US.

The machines’ longstanding strengths – their low cost to operate, round-the-clock presence and brand promotion and advertising role – remain as powerful as ever. Coca Cola Bottlers Japan Inc, which operates nearly a quarter of all Japan’s machines, says they are its single most profitable channel.

But with Japan’s population ageing and shrinking, leading to the number of machines across the country falling by a fifth in the last decade, companies are now looking for new ways to keep vending machines relevant.

One answer is to come up with new business strategies. Japan’s Family Mart convenience store chain now operates ensembles of vending machines to provide a pared down range of best-selling goods in locations with low foot-traffic flows. Similarly, Seven Eleven has been experimenting with making some stores vending-machine only operations during the night to overcome the problem of finding staff willing to work anti-social hours.

Another answer is to build on Japanese expertise. In 2019, Thailand’s Osotspa, whose product range includes sports and energy drinks, bought a majority stake in Japanese-owned local vending machine operator Asia Vending Machine Operation Co to expand its sales and distribution channels and extend its brand presence.

The same year, Etika, the Malaysian subsidiary of Japanese drinks giant Asahi, bought Singapore’s Advend to make itself the largest independent vending machines provider in Malaysia and Singapore.

But more important for the machines’ long-term viability are the new functions that digital and other new technologies are making possible. Harnessing in-machine sensors for data analytics now allows vendors to make sure machines run at peak efficiency by monitoring stock levels and maintenance needs.

Electronic payment systems allow vendors to gather information about customers and their preferences

Payments can be taken from all types of electronic payment devices, from mobile phones to contactless cards, ending the need to collect cash, but also allowing vendors to gather information about customers and their preferences.

This is allowing companies to anticipate changes in demand and better target different machines at different groups of consumers. Tokyo-based business software developer 600 Inc is using artificial intelligence to devise product optimization strategies and replenishment route-planning for vending machines and other staff-less retail outlets.

And JR East Water Business, which places its Acure brand vending machines in train stations across Japan, has separate ranges of machines aimed at women, the health conscious and art lovers. Its Acure Pass app both lets people choose and pay for drinks for themselves and give them to friends via social media.

In South Korea, convenience store chains Emart24 and CU have launched new vending machines with AI-enabled identity verification to comply with alcohol sales laws. This could further boost the growth potential of the country’s 600 unmanned convenience stores.

China is another hotspot for vending-machine innovation. E-commerce giant JD.com has rolled out AI-supporting machines developed by its logistics innovation lab, JD-X, with QR codes used to release grocery items from machines and charge a buyer’s digital wallet. Shanghai-based DeepBlue links the readers to an e-wallet that allows customers to buy goods by inputting a few digits then presenting their palm to a scanner.

Beijing Kuo’an Science and Technology now offers machines that can automatically weigh and calculate the price for all purchases. As shown by the US’s Chowbotics, recently acquired by food-delivery platform DoorDash, robotics can take such machines to the next level with machines that can make salads on the spot.

But the most successful business so far is China Pop Mart, started in 2011 by entrepreneur Wang Ning, which sells “mystery” dolls and figurines packed in sealed boxes through a chain of vending machine “roboshops”. As the dolls’ popularity took off, Wang also took his business online, offering the dolls through Alibaba’s Tmall e-commerce website, and secured licensing deals with Walt Disney and Universal Studios. At the end of 2020, he raised US$675 million through a Hong Kong listing that valued his company at US$14 billion.

What lessons can we draw from vending machines’ evolution? Retailing’s landscape is undergoing dramatic change. But just as the radio did not disappear with the advent of television, the vending machine is unlikely to vanish because of the rise of e-commerce.

Recent technological enhancements have cut the machines’ logistics and other operational costs, raised the quality of experience for their users and broadened their relevance for omni-channel strategies. Rising incomes and consumption point to a future with more impulse sales. Higher labor costs are putting brands and retailers are under increasing pressure to automate selling and delivery.

Smart vending machines also create paths for other traditional channels. From door-to-door direct sales to brick-and-mortar stores, automated retail solutions will draw on the new technologies, logistics solutions and data tools that are now broadening the appeal of vending machines for both consumers and retailers. Standing at the convergence point of convenience, digitalization and automation, the machines look certain to hold their position for many years to come.

Professor of Strategy and Innovation at IMD

Patrick Reinmoeller has led public programs on breakthrough strategic thinking and strategic leadership for senior executives, and custom programs for leading multinationals in fast moving consumer goods, telecommunications, pharmaceuticals, healthcare, and energy on developing strategic priorities, implementing strategic initiatives, and managing change. More recently, his work has focused on helping senior executives and company leaders to build capabilities to set and drive strategic priorities.

16 October 2023 • by Mohan Subramaniam , Richard Roi in Asian hub

Leveraging real-world data can be transformative, and leaders need to both transform their core activities and pursue new opportunities....

2 October 2023 • by Kati Suominen in Asian hub

Asian governments should converge trade rules and improve the ease of doing digital business across borders so more enterprises can benefit from the e-commerce boom, says Kati Suominen....

28 August 2023 • by Mark J. Greeven in Asian hub

New IMD data will gradually shed light on sector-by-sector secrets of those firms reinventing themselves for the world’s second-biggest market with success...

17 July 2023 • by Jörg Wuttke in Asian hub

China’s economy may be coming back to life, but many headaches remain for foreign business in the country, says Joerg Wuttke, president of the EU Chamber of Commerce in China until May...

Explore first person business intelligence from top minds curated for a global executive audience