Lessons for the world

So how should leaders, inspired by China’s retail revolution, transform their organizations if they want to deliver?

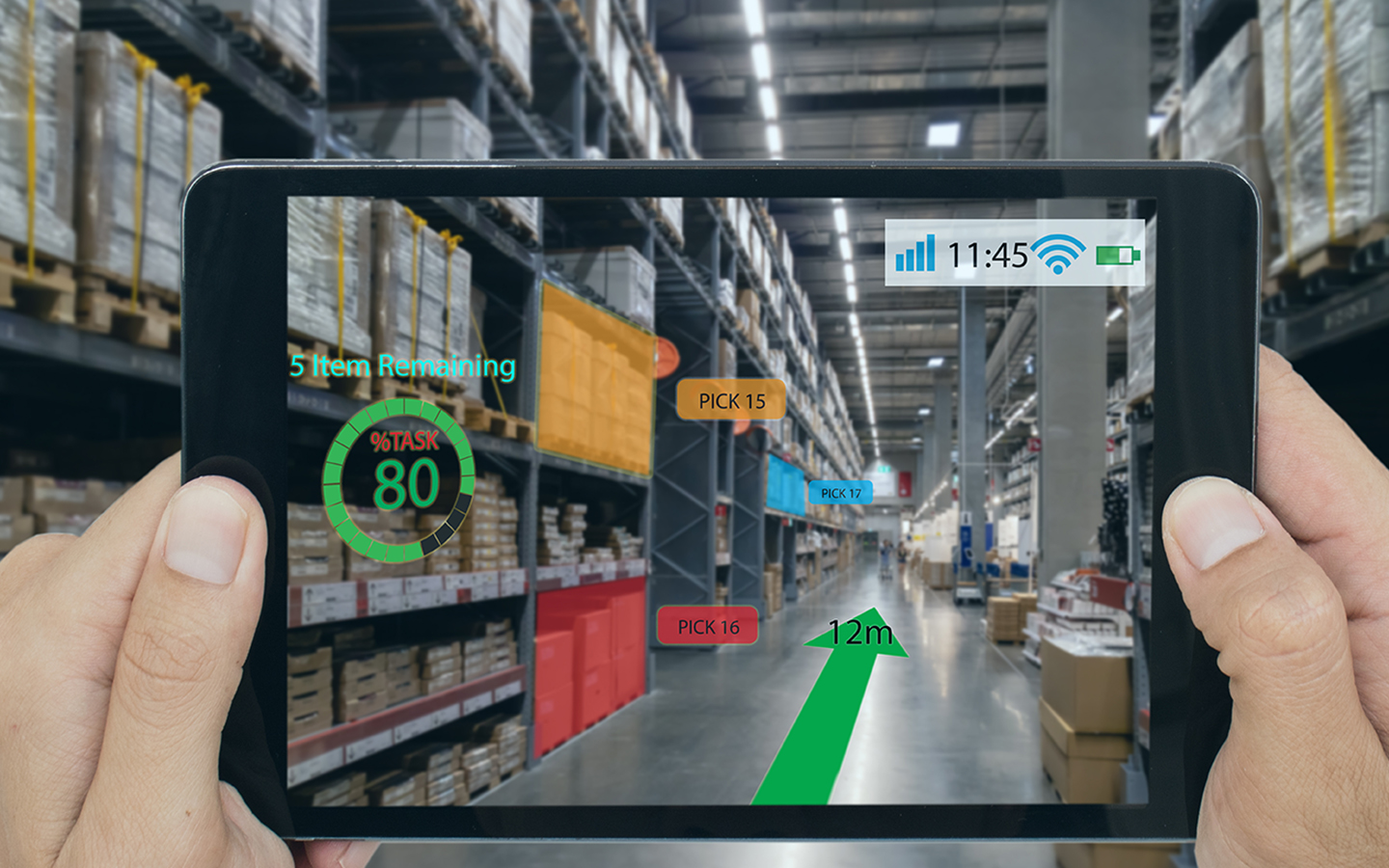

The key to resolving this problem lies in thinking through the consequences of having a truly consumer-centric business. In these circumstances, it no longer makes sense to think of having separate sales, marketing, public relations or other arms, but rather of coming up with a whole new operating model that combines these internal processes. Many retail models focus on customer experience innovation through digital channels. But new retail is distinguished by its focus on digital transformation, which integrates the entire supply chain from sourcing through manufacturing to delivery to end user experience. This way, new retail puts the customer at the center through front end and back end digital transformation.

In this new world, it also makes little sense to think in terms of channels; the key challenge is to think of the different ways in which you can engage the consumer. As China has shown with the ecosystem built around super-apps, there are ways – but it is not easy. Still, with this renewed focus, the opportunity for companies to deliver what their consumers actually want, and in a direct, seamless and efficient way, is enormous.

Making sense of this calls for new ways of thinking – often requiring rich experience and know-how to be turned on its head. As Edoardo Tocco, President, Balenciaga Asia Pacific, a participant in the Industry Dialogue Series observed, “We no longer sell products, we sell experience.”

The revolution has just begun

Much remains to be explored in this new retail world – and even more issues remain to be addressed. As Irene Lau, Managing Director, Watsons Singapore, noted, while livestreaming clearly works well in China, its applicability in a smaller market such as Singapore remains an open question: “China’s innovation in e-commerce is intriguing. Driven by imagination, pace and such mass adoption, this convergence of commerce and entertainment sets a good reference point for Singapore to adapt off.”

There are also question marks over how replicable learnings in one retail sector might be for others. “We’ve just launched a super-app and an e-commerce solution,” said Mark Sage, COO, DFI Retail Group. “We know this can work for beauty, but what about groceries?”

Still, there is one thing that is certain: China stands at the center of world retail innovation. The revolution launched by its livestreamers, super-apps, social commerce and other new practices has only just begun.